Noam Galai/Getty Images for TechCrunch

- Robinhood traders will now be allowed to buy up to 100 shares of GameStop.

- Shares of Koss, Blackberry, and Genius Brands have been unrestricted entirely.

- Robinhood explained its move to restrict trading in a blog post on Friday after being sued by customers.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Robinhood continues to rollback its trading limits on stocks favored by Reddit’s Wall Street Bets forum and retail traders.

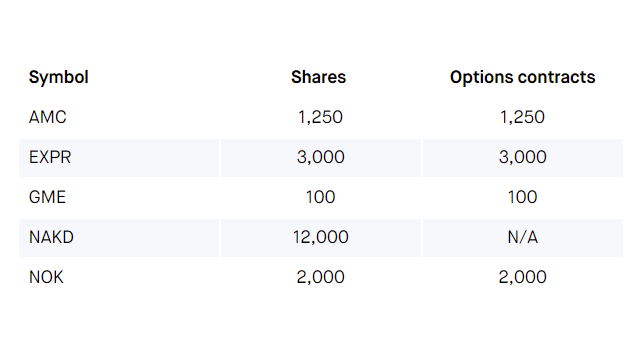

The company released a revised restricted list Tuesday morning that shows customers how many shares of each popular stock can be bought at this time.

According to the list, Robinhood customers can now buy up to 100 shares of GameStop, an 80 share increase from the 20 shares the app previously allowed.

Other major stocks listed on the restricted list include AMC, Express, Naked Brand, and Nokia. While Koss, BlackBerry, and Genius Brands were removed from the restricted list entirely.

Robinhood

Despite the easing restrictions, customers will still be limited in what they can buy. Robinhood says customers won't be able to open new positions in any of the securities listed unless their account holdings are below the respective limit.

Customers also won't be allowed to buy fractional shares at this time.

The company was hit by accusations of market manipulation at the behest of hedge funds when it first restricted buying of certain stocks last week, and in the days since, the brokerage has been hit with dozens of legal suits.

In an attempt to explain the situation, Robinhood released a blog post last Friday detailing the challenges the brokerage has experienced since the start of the Reddit-fueled day trading saga.

In the article, Robinhood explains how clearinghouses work and the financial requirements for brokerages. The company argues it wasn't their choice to restrict buying but rather a function of clearinghouse requirements meant to prevent systemic risk.

"It was not because we wanted to stop people from buying these stocks." Robinhood said, "We did this because the required amount we had to deposit with the clearinghouse was so large-with individual volatile securities accounting for hundreds of millions of dollars in deposit requirements-that we had to take steps to limit buying in those volatile securities to ensure we could comfortably meet our requirements."

Robinhood was hit so hard by clearinghouse requirements after Reddit traders jumped into popular stocks that they were forced to ask investors to put $1 billion into the company. And on Monday, the company raised an additional $2.4 billion.

Now, House Democrat Maxine Waters is likely to call on Robinhood's CEO Vlad Tenev to testify in Congress on February 18, Politico reported.

Dit artikel is oorspronkelijk verschenen op z24.nl